Colombia vio crecer su economía de

forma paulatina el pasado año, expandiendo un 4.3 por ciento en el 2013. No

obstante, la 4ta mayor economía de América Latina crecerá de forma notable

durante los próximos cinco años. Esto se debe a las intervenciones por parte de

instituciones públicas y privadas, con la única finalidad de promover el desarrollo

del ámbito comercial y reducir la exclusión social. En otras palabras, el

crecimiento de la economía Colombiana será catalizada principalmente por el

sector de construcción e infraestructura.

No obstante, debe tenerse en cuenta que el peso Colombiano podría verse

afectado por las siguientes causas:

1. Continúa reducción de compra de activos por parte del

Banco de la Reserva Federal de los EE.UU., y posible aumento de la tasa de

interés en el 2015.

2. Crecimiento económico moderado de la Unión Europea y zona

euro; así como el posible Flexibilización Cuantitativa que el Banco Central

Europeo (ECB) llevaría a cabo para combatir el estancamiento económico.

3. Una reducción de la inversión directa extranjera, y retos

que podrían generarse en el nuevo programa de cuarta generación de

concesionales viales (4G).

Colombia es uno de los países con mayor potencial de crecimiento a largo

plazo, no tan solo en la región Latino Americana, pero a nivel mundial. En la

pasada década, el PIB per cápita se ha duplicado, y ha habido un incremento

robusto en la inversión tanto pública como privada. Esto se debe a un incremento

exorbitante en la seguridad interna y la amplia diversificación económica que enriquece

al país. Colombia, miembro de la Alianza del Pacifico (AP), es mayor exportador

de petróleo, oro, café, flores, carbón, entre otros.

Instituciones internacionales se han percatado del gran potencial que tiene

Colombia. La aseguradora Coface ha incluido Colombia dentro de su lista de

países “neo-emergentes”, llamada los PPICS (Perú, Filipinas, Indonesia,

Colombia y Sri Lanka). Por otro lado, The Economist Intelligence Unit, ha listado

su acrónimo de un grupo bastante prometedor, los CIVETS (Colombia, Indonesia,

Vietnam, Egipto, Turquía y Sudáfrica).

‘Boom’ De Infraestructura Reforzará Economía

BMI View: Seguimos siendo optimistas hacia la industria de la

construcción en Colombia en el corto y mediano plazo. Como tal, pronosticamos

un sólido crecimiento real de 8,4% en 2014, cuando esperamos que la

adjudicación de grandes proyectos de infraestructura a realizarse. Este

panorama positivo es apoyado por un mejor ambiente de negocios y un oleoducto

fuerte de proyectos, especialmente en el sector del transporte - que sigue

representando la mayor proporción de proyectos de infraestructura - y el

segmento de infraestructura de energía y servicios públicos. Fuerte crecimiento

en el año 2014 es una continuación de una tendencia

que surgió en el 2013, cuando la industria experimentó un crecimiento estimado

de 10,5%.

Fuente: www.businessmonitor.com (Traducido al Español)

Para una economía incentivar la productividad y el desarrollo económico

sostenido, la inversión en infraestructura es ineludible. En las pasadas

décadas, Colombia ha mostrado una dilación (<1% del PIB) en la inversión de

la misma, en comparación a otras economías emergentes. No obstante, es preciso

resaltar el entorno actual del sector de infraestructura colombiano. La Agencia

Nacional de Infraestructura (ANI) ha planteado una serie de proyectos que suman

un aproximado de US$47bn en un plazo de cinco años. Entre ellos, se encuentra

el programa de Cuarta Generación de

Concesiones Viales (4G), el cual consiste de un total de cuarenta obras y

sobre 8,000km de carretera. Inclusive, la Agencia Nacional de Infraestructura

(ANI) espera que contribuya alrededor de 0.5 puntos porcentuales del

crecimiento del PIB en los próximos cinco años. También para resaltar, el

Consejo Superior de Política Fiscal (Confis), aprobó un total de diez

concesiones viales con un valor de US$12.79bn, pertenecientes al Programa Autopistas para la Prosperidad.

Se espera que el sector de infraestructura en Colombia conlleve más de 3 por

ciento del PIB en los próximos años.

Sector Inmobiliario Crecerá en el 2014

Es evidente que durante el año previo, Colombia se destacó en el sector de

la construcción, creciendo 15.4 por ciento en construcción de edificaciones

residenciales. El sector inmobiliario, el cual proveerá un continuo soporte al desarrollo

del sector en el 2014, es producto del presente auge en la construcción de

Viviendas de Interés Social (VIS). Las VIS están dirigidas a familias de

ingreso medio y medio-bajo.

Adicionalmente, el vigente marco inmobiliario muestra soporte al

crecimiento de otros sectores; en especial el minero, el cual ha visto crecer

la demanda de cemento y petróleo. Sin embargo, uno de los retos que podrían surgir

sería el aumento de los precios de viviendas. Para contrarrestar este evento, debe

haber una mejora en los balances de hogares.

Inclusión Financiera Sigue Siendo Un Desafío

Colombia carece de un sistema financiero inclusivo a nivel nacional. Según

la Encuesta Global de Inclusión Financiera del Banco Mundial (Global Findex),

tan solo un 30 por ciento de la población Colombiana posee algún tipo de cuenta

bancaria. Para incentivar un crecimiento sostenido, las bancas deben promover

sus servicios en áreas rurales y con baja densidad poblacional. También, las

entidades financieras y organismos reguladores deberán crear nuevos canales de

acceso para ampliar la cobertura de servicios bancarios. Esto brindaría

innumerables beneficios tales como: disminuir costos transaccionales, menor uso

de efectivo, reducir corrupción y actividades ilícitas, incrementar la demanda

interna, incitar el ahorro e inversión, etc. La profundización del canal

tecnológico (Internet Banking) debe ser el primero en la lista de promoción

principalmente debido a su accesibilidad.

Por otra parte, es preciso resaltar la presente ley de inclusión financiera

que se viene debatiendo en la Comisión Tercera del Senado. La nueva ley fue

descrita por la agencia de noticias, Colprensa, de tal manera:

“La iniciativa busca la creación de entidades especializadas en pagos,

ahorros y depósitos, que según el ministro de Hacienda, Mauricio Cárdenas,

estarán facultadas para captar depósitos, y no prestarán ni invertirán recursos

del público; sino que éstos deberán ser depositados en el Banco de la

República.”

Perspectiva de

Inversión

Colombia tiene un increíble potencial de crecimiento durante los próximos

cinco años. El desempleo ha reducido substancialmente en la pasada década,

posicionándose alrededor de 8.7 por ciento en el 2013 de una población de 47

millones. La inflación permanece estable, culminando el mes de Abril en 2.51

por ciento; entre la meta del Banco de la Republica (2% - 4%). De igual manera,

el gobierno ha optado medidas para desplazar la violencia interna y el

narcotráfico, moldeando un país más seguro para inversionistas extranjeros. Una

forma sencilla de exponerse directamente a este mercado Andino es tras los

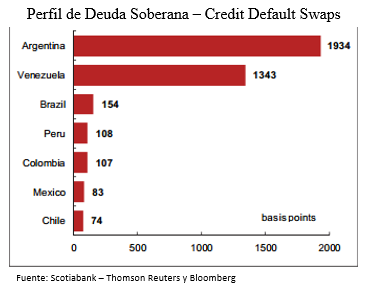

ETFs: $ICOL - $GXG - $COLX. Ambas agencias de calificación, Moody’s y Standard

& Poors, colocaron un grado adecuado en la deuda soberana de la nación: BBB

y BAA3, respectivamente.