Alexander Schachter

Nov 18, 2013

Recommended Documentary: The Midas Formula: Trillion Dollar Bet

"The history behind perhaps the greatest formula ever created in finance: the Black-Scholes-Merton options pricing model. Two of its creators were awarded the Nobel Prize in Economics in 1997. A year later their hedge fund Long Term Capital Management (LTCM) had collapsed with staggering losses of $100 billion due to significant leverage of the strategy."

Alexander Schachter

Alexander Schachter

Nov 17, 2013

Recommended Documentary: The Wall Street Code

Alexander Schachter

Nov 16, 2013

Recommended Documentary: Money & Speed: Inside the Black Box

"A thriller based on actual events that takes you to the heart of our automated financial world. Based on interviews with those directly involved and data visualizations up to the millisecond, it reconstructs the fastest and deepest U.S. stock market plunge ever." VPRO DIGITAAL

Alexander Schachter

Oct 21, 2013

If the resolution does not show up well, watch on Youtube:

I also posted each individual chart of my watchlist in the previous post.

Oct 20, 2013

Sep 29, 2013

Sep 8, 2013

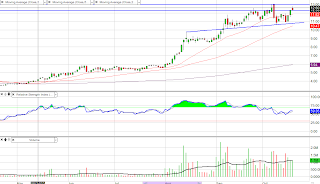

$CPRT DAILY

$CPRT DAILY ZOOM

$VCI DAILY

$CODI DAILY

note: wp=weak pivot mp=medium pivot sp=strong pivot

Alexander Schachter

Alexander Schachter

Aug 29, 2013

Here is an interesting chart I created.

DAILY CHART

DAILY OVERVIEW

Applied Materials, Inc. (1.10%) is

currently trading very close to a notable support around $15 that has been tested

again in the past few days. Is very probable that $AMAC will see a trend

reversal in the upcoming weeks if the support holds strong, otherwise, I would

place a tight stop order right below 14.90.

The importance of the $15 dollar mark for $AMAC relies on seven

main events:

(1)

Testing

10-month ascending trend line

(2)

Testing 4-month horizontal trend line

(3)

Testing most significant Probability Cone support

(4)

Testing short-term Regression Channel lower

descending line(red)

(5)

Trading at 25% Retracement from 11/16/12 bottom

(6)

Oversold RSI

(7)

Bullish secondary trend with higher highs & higher

lows

Some events to be aware of:

(1)

$AMAT trading below 20-50sma in daily time frame

(2)

MACD still below divergence line & signal

line still bearish

Alexander Schachter

Jul 1, 2013

Here is an interesting chart I created.

$LINC shares have slumped about 18 percent after the

for-profit education company announced on June 20th it will be

closing 5 of its 38 campuses in order to augment the company’s financial.

I will solely emphasize on a daily time frame, identifying various S&R levels that could be

very profitable if executed with a proper strategy and risk management. I am

going to start off by covering the first enclosed image that basically focuses on

three main events:

(1) The stock saw a breakout below a 7-month ascending trendline.

(2) $LINC has built a decent price action along a Fibonacci

retracement setup; my next price target is around the 25 percent line ($5.00).

(3) Another simple strategy that should not be overlooked is

the Slow Stochastic oversold/bought levels; this accompanied with price

reaching a major support/resistance, might

indicate a possible trend reversal.

In the second image I highlight a graphical forecast of a

probability cone I placed from June 2012. Basically, it indicates a set of

probable future price ranges which $LINC might

encounter. The forecast has proven itself in numerous occasions,

validating my price target mentioned before around the lower blue line; proximate

to the $5 dollar mark.

Alexander Schachter

Jun 9, 2013

Here is an interesting chart I created.

MONTHLY CHART

DAILY CHART

Hewlett Packard seems to be on the verge of a possible

turnaround after reaching a major lower support that was tested back in 2002;

being a level which $HPQ concluded the aftermath of the dot-com bubble’s burst.

$HPQ chart indicates the stock being on an uptrend following a series of higher

highs and higher lows since it hit grounds back in late 2012. I think $HPQ might see a much stronger accumulation

in the mid-term, given the fact it broke a lower channel extension that has

served as a trend reversal S&R for about 5 years. At this point we should

look further onto the $25.50~26.00 dollar mark, being the next most eminent resistance for $HPQ. The Volume by Price indicator

reflects the volume of a specific price range. A large Volume by Price bar

suggests a strong historical interest for the security at a given price range;

it should be seen as a possible

resistance in this case. If a breakout follows through, the price target would

be $28.50, subsequently following $30.00

- $33.00 - $37.50

and so on; considering a best-case scenario. $HPQ is still more than 54% down from 07’ and

10’ double top peaks, making room for great returns if the turnaround gains

momentum and the company regains market share.

If interested

on a nice analysis about the company’s fundamentals, I recommend this article: http://seekingalpha.com/article/1485451-hewlett-packard-is-this-a-turnaround

Alexander Schachter

Jun 6, 2013

May 15, 2013

Here is an interesting chart I created.

DAILY DOT CHART

DAILY CANDLE CHART

60MIN CHART

Advanced Micro Devices Inc. reported a first quarter EPS of

-0.13, well above (25.77%) the consensus estimate of -0.18. $AMD stock price has

been experiencing strong accumulation after the company announcing that new

servers will be launching on its technology at a much cheaper price. Current

trend for $AMD appears to be very bullish with a strong potential of reaching

the upper channel extension in the mid term.

I am going to start off by covering the first image (Daily Dot Chart). I changed the price settings to a Dot graph because I want to make

evident past gaps that are significantly important for the forthcoming price

action. Gaps most of the times serve as very strong S&R levels, also they

tend to repeat themselves close to where they occurred in the past; so after

$AMD breaks the $4.30 support, we could see a large gap in the next opening or

so.

Important levels to pay close attention are around:

$5.50—$5.30—$4.80—$4.30—$4.00.

I bought shares at 4.06 after breaking above the $4 support,

closing the day about 5.8% up. Personally I discovered $AMD a bit late, not

being able to buy right above the lower channel extension, however I think

there is still immense opportunities of profit at current levels. $AMD shows a

Volume by Price with strong support around the $5.30—$5.50 level; notice that

it is one of the lenghiest bars in the graph. If we get to see a breakout above

that Volume by Price bar, one could predict higher prices, eventually reaching

the upper channel extension.

Other events to consider: MACD is bullish; RSI is

overbought, not meaning there is going to be a reversal, though a soft

consolidation might soon originate.

The second image is based on a 60min time frame. $AMD

appears to have a rising wedge pattern with a successful bullish breakout; right

below the upper line is a decent exit point just in case there is any pullback which

$AMD might eventually encounter. In

conclusion, I am long $AMD since $4.06 with a strong bullish forethought.

Alexander Schachter

Subscribe to:

Posts (Atom)

0 comments: